The reporting requirements for asset management companies have exploded in recent years, based on 3 distinct components

- Own regulations – PRIIPS, MIFID 2, SFDR / SDR, LEC 29, CSRD

- Legacy regulations – Solvency 2 (EU & UK), HK-RBC, Basel 3

- Client demands – institutional, distributors

If an asset management company with a strong commitment to a given client base has to have a minimum command of the regulations – and therefore the constraints – of its clients, it is de facto no longer possible to control the whole, nor to have the tools and data necessary for these periodic productions.

Sequantis has a long history of working with asset management companies to provide them with all the information they need for Solvency 2 – TPT, SCR calculations, QRT, ancillary securities accounting.

Over the last 5 years, Sequantis has extended its offering to include all the reporting required by its customers, in order to provide them with a global reporting service.

This value proposition is based on a simple idea: pool all the data and all the processing, and offer a portfolio analysis and simulation tool based on the same data and processing.

Holdings based reports

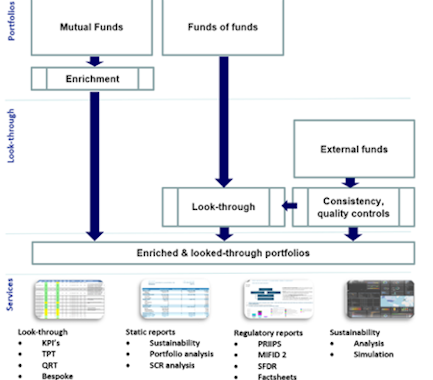

The underlying idea is quite simple – manage holdings once, and use them to generate all needed reportings. To achieve this goal, Sequantis has built up a combination of a highly skilled team, a range of productive tools, and a database of securities, issuers and extra-financial data.

This allows an unique combination of managed & self-service approach – Sequantis team manages & validates all hodlings data, allowing then our clients to generate as many reports as they need. This approach allows us to offer very competitive prices for a global offer.

We cover TPT, QRT (Solvency 2), VaG, CRR, GroMiKV, KVG, EET & all kind of specific reports.

Capital requirement computation

Even if asset managers are not regulated, they have inherited capital requirements regulations from their insurance or banks clients.

Sequantis is involved in capital requirements computations since more than 10 years, providing these computations to asset owners. And capitalizes on these works to offer to asset managers the same quality of service as a computation agent.

We cover Solency 2 in its EIOPA & PRA version HK-RBC regulation, CRD 4 (CRR A to D & KVG reports). Our computation engine are audited – by our institutional clients, or by external auditors.

PRIIPS & MIFID 2

PRIIPS and MiFID II both set out to improve the information provided to investors, enabling them to compare products in terms of fees and performance and thereby creating a truly European market for retail investment products. This means that asset management companies are required to produce new types of reports. This burdensome task can be made easier with assistance from the teams at Sequantis. Sequantis has created a data storage platform for all the requisite data, which will be fully audited. The platform makes it possible to generate custom Key Information Documents (KID), which have to be issued to retail investors, in real-time and in multiple languages if needed for products marketed in different countries.

We cover KID PRIIPS, UCITS KIID (UK version), EPT, CEPT, EMT, ex-ante fees reports.

Sustainability & SFDR

Sustainability regulations are consuming a lot of data, that have to be aggregated & controlled. Moreover, as some regulations do not clearly define the rules, each player has to define and put in place its own set of rules, to monitor sustainable investments or more generally its internal investment policy.

To answer all regulations, with a consistent set of rules and data, Sequantis manages:

- a proprietary issuer master file

- mapping of all extra-financial data against this IMF

- control of all incoming data

This set of data, combined with Sequantis Transition Monitor, allow each client to put in place its internal rules, and monitor / simulate its investment portfolios.

This offer, coupled with Sequantis look-through capabilities, is a unique answer to funds of funds managed as SFDR article 8 or 9.

Data Solutions

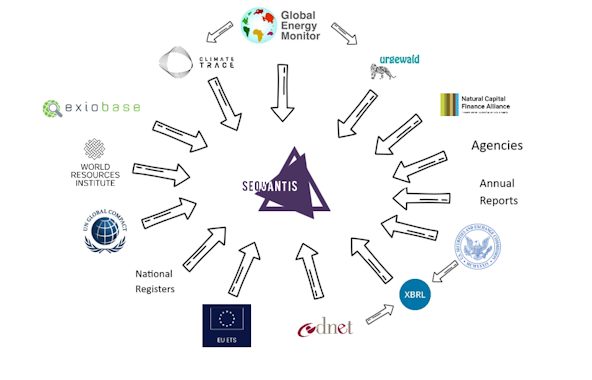

The increase in the number of non-financial regulations has considerably increased the cost of data, and historical sources only partially meet the need for audited data from CSRD-type regulations.

Today, data is being structured, under the aegis of global regulators, among others. Access is greatly simplified, and we can anticipate that this is only the beginning. In this context, the issue is no longer the data itself – all stakeholders will be able to retrieve it – but its use, in particular mappings and controls. In this context, Sequantis wanted to launch a global offer of collected data, supplemented by the results of “models” if necessary.

This offer can be summarized as data + controls + mappings + calculations – and excludes any notion of subjective analysis

We cover PAI, taxonomy (all), SBTI, ENCORE (biodiversity), & companies breakdowns (needed to compute climate risks).

Client reporting

Today’s regulations are numerous, and require considerable data sets. These databases, which were initially set up to meet these regulatory challenges, are often under-utilised: fund look-through, which is necessary for Solvency 2, CRD 4 and sometimes SFDR regulations, the data required for PRIIPS, and the data required for SFDR & CSRD extra-financial regulations.

In order to generate reports for end customers, and therefore a very large number of documents, it is necessary to rethink the current reporting chains, which are usually based on a final validation of each document – an impossible task for large volumes.

Having validated data and processes for generating reports means that we can respond efficiently and securely to the automated generation of a very large number of reports – a key factor in providing customised reports to end customers.