Sequantis, dedicated asset servicing for institutional investors

Sequantis provides dedicated services to institutional investors: insurance companies, mutuals, retirement funds as well as non-profit associations and foundations. Sequantis revalues institutional investors’ portfolios on a weekly or monthly basis. The team at Sequantis processes the full financial and accounting dataset, calculating all indicators needed by institutional investors to create all their reports: accounting, financial and regulatory.

Data collected and reprocessed by Sequantis can be used by finance directors and their teams to create all the dashboards needed to manage their activities.

Our platform interfaces with standard bookkeeping software packages. It is sufficiently flexible to be configured to handle different charts of accounts and the specific requirements of insurance and mutual companies.

Our clients are able to create comprehensive accountancy reports for use by finance departments and senior executives, as well as being able to assess taxable gain liabilities.

Look-through, from nice-to-have to mandatory

Portfolio look through involves communicating all positions line by line, be these mandates or open-ended UCITS. This is an obligation incumbent on all institutional investors subject to Solvency 2, which allows to have a partial look-through. With the coming into force of sustainability regulations, but also with the implementation of sustainable investment policies internally, look-through is more and more needed, particularly to monitor exclusions – fossil fuels, tobacco, alcohol, or any other sin sectors.

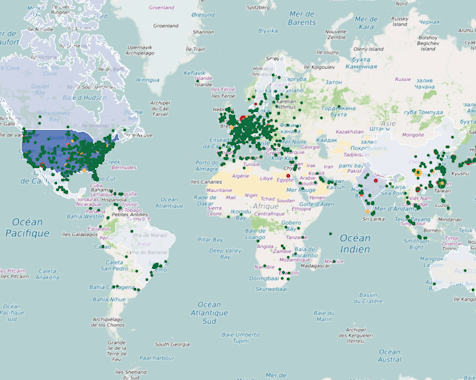

Sequantis started to look-through mutual finds 14 years ago, and is now a key player in this area. Staff at Sequantis will retrieve TPT files, check and standardize the data before reassembling the complete dataset. The scope of supply for this service includes data cleaning, SCR ratio calculations and aggregation of underlying funds.

To answer all clients’ needs, providing the service at the best price, Sequantis has developed two different approaches for the look-through: an “ESG” look-through, to determine all issuers precisely, and mapped them amongst extra-financial data, and a “risk” look-through, adding securities, listed & OTC, controls and cleaning, to ensure a proper risk computation at the end, whatever the risk metric – SCR or any financial risk.

Capital requirement

Sequantis can handle for its clients SCR computation, and every QRT linked to the investment portfolios.

Our R&D department follow the regulations, and anticipate all future requirements. Since 2019, Sequantis has implemented several pilot exercises – stress-tests, climate stress-tests – allowing our clients to anticipate what could be the change in the capital requirements in the coming years.

Sequantis tool also allow the clients to set-up derived models – for ORSA purposes, or internal supervision.

Sustainability & data solutions

There are numerous sustainability regulations, including LEC (FR) article 29, SFDR, Taxonomy article 8, NFRD / CSRD. Prudential regulations such as Solvency 2 and Basel 3 have begun to incorporate sustainability risks, in parallel with a series of pilot exercises requested by banking and insurance regulators. Finally, the international ISSB standard has defined the IFRS Sustainability Disclosure Standards.

Many of these approaches will require the definition of rules – from investment policy to double materiality, via the definition of the sustainable share for SFDR. A rules engine with unified parameterisation is therefore necessary beyond the data set.

Producing this entire set of reports also makes it possible to manage investments, using the same data and the same engines.

Client reporting

Today’s regulations are numerous, and require considerable data sets. These databases, which were initially set up to meet these regulatory challenges, are often under-utilised: fund look-through, which is necessary for Solvency 2, CRD 4 and sometimes SFDR regulations, the data required for PRIIPS, and the data required for SFDR & CSRD extra-financial regulations.

In order to generate reports for end customers, and therefore a very large number of documents, it is necessary to rethink the current reporting chains, which are usually based on a final validation of each document – an impossible task for large volumes.

Having validated data and processes for generating reports means that we can respond efficiently and securely to the automated generation of a very large number of reports – a key factor in providing customised reports to end customers.