Sequantis has a unique positioning, working for both asset managers and asset owners – we produce and consume data at the same time, allowing us to master the entire production process

Combining our services, we are able to answer to all our clients needs, current and future, and optimize the data usage

We are convinced that data are today underused by institutions, and particularly in the reporting area – an insurance having to look-through mutual funds to compute solvency requirements can at marginal costs build up an end-client report using the look-through data

Asset owners

Regulatory requirements have increased considerably in recent years, and despite all the announcements of simplification, this trend is likely to intensify, generating a substantial increase in operating costs. Responding to all these demands requires more and more data, more and more tools, and more and more in-house skills.

To resist this tidal wave, pooling seems a natural and efficient solution. For its insurance and mutual insurance customers, Sequantis pools a range of services, data and tools for portfolio monitoring, ancillary securities accounting, funds look-through, SCR computation and validation, risk and climate risk calculations, and extra-financial reporting.

Asset managers

The reporting requirements for asset management companies have exploded in recent years, based on 3 distinct components

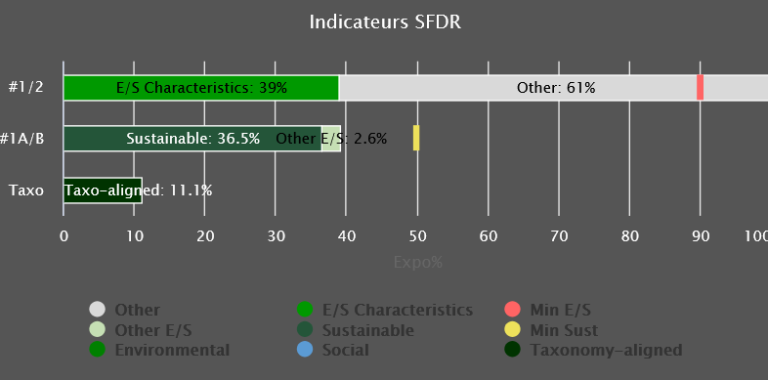

- PRIIPS, MIFID 2, SFDR / SDR, LEC 29, CSRD, Taxonomy

- Solvency 2 (EU & UK), HK-RBC, Basel 3

- Client demands – institutional, distributors

If an asset management company with a strong commitment to a given client base has to have a minimum command of the regulations – and therefore the constraints – of its clients, it is de facto no longer possible to control the whole, nor to have the tools and data necessary for these periodic productions.

End clients reporting

Today’s regulations are numerous, and require considerable data sets. These databases, which were initially set up to meet these regulatory challenges, are often under-utilised: fund transparency, which is necessary for Solvency 2, CRD 4 and sometimes SFDR regulations, the data required for PRIIPS, and the data required for SFDR & CSRD extra-financial regulations.

In order to generate reports for end clients, and therefore a very large number of documents, it is necessary to rethink the current reporting chains, which are most often based on a final validation of each document – an impossible task for large volumes.

Having validated data and processes for generating reports means that we can respond efficiently and securely to the automated generation of a very large number of reports – a key factor in providing customized reports to end customers.

Sustainability

Sustainability regulations are multiplying, some of which require results to be auditable. A single set of data and processes is needed, as this is the only way to produce consistent reporting and to bring together all the teams involved, from investment to accounting and ESG.

There are numerous sustainability regulations, including LEC (FR) article 29, SFDR, Taxonomy article 8, NFRD / CSRD. Prudential regulations such as Solvency 2 and Basel 3 have begun to incorporate sustainability risks, in parallel with a series of pilot exercises requested by banking and insurance regulators. Finally, the international ISSB standard has defined the IFRS Sustainability Disclosure Standards.

Many of these approaches will require the definition of rules – from investment policy to double materiality, via the definition of the sustainable share for SFDR. A rules engine with unified parameterisation is therefore necessary beyond the data set.

Producing this entire set of reports also makes it possible to manage investments, using the same data and the same engines.

Our offering can be summed up as audited and unaudited data + rules engines + calculation and reporting engines + analysis and investment management tools – and enables us to address the issues of complexity, volume and consistency while minimizing costs.

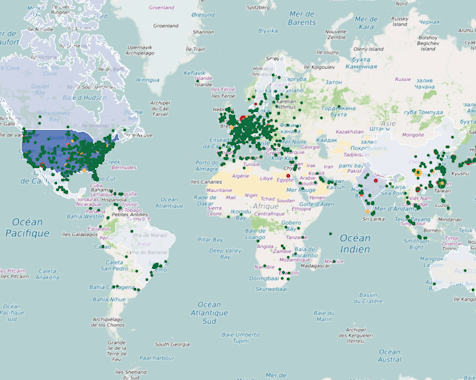

Portfolio look-through

Funds look-through started 10 years ago with the Solvency II directive, first regulation asking explicitly for a look-through – but still allowing turnarounds with the proportionality principle, respecting the prudent person principle. Then Basel 3 applied a similar approach.

The most important change came with sustainability regulations, and particularly all rules based on exclusions – fossil fuels as example. To demonstrate a zero exposure in any sin sector, a full look-through is then mandatory.

The look-through should answer the needs, whatever they are.

An “ESG look-through” has to identify all issuers, and to ensure all extra-financial data are properly projected on the whole portfolio.

A “Risk look-through” has, in addition, to ensure all securities, listed & OTC, are properly modeled to allow a proper assertion of financial risks.

Sequantis has developed and implemented the two approaches, to answer all its clients needs.

Simulation

Simulation tools were, in the extra-financial area, a nice-to-have not so long ago. But, with the multiplication of regulation or internal investment policies constraints, a simulation engine able to monitor all constraints is now a mandatory tool for asset owners & asset managers.

Sequantis Transition Monitor was built up to allow Sequantis’ clients to define and monitor all type of investment constraints – labels, investment policies, SFDR / SDR, extra-financial risks.

STM is used by portfolio managers, ESG team, risk team.